Running a small or medium-sized business today is no longer just about selling well — it’s about tracking well.

Many profitable businesses still struggle with cash shortages, delayed payments, missed opportunities, or sudden stress — not because money isn’t coming in, but because it isn’t being tracked, timed, or planned properly.

The good news?

SMEs no longer need expensive software or large finance teams to stay in control.

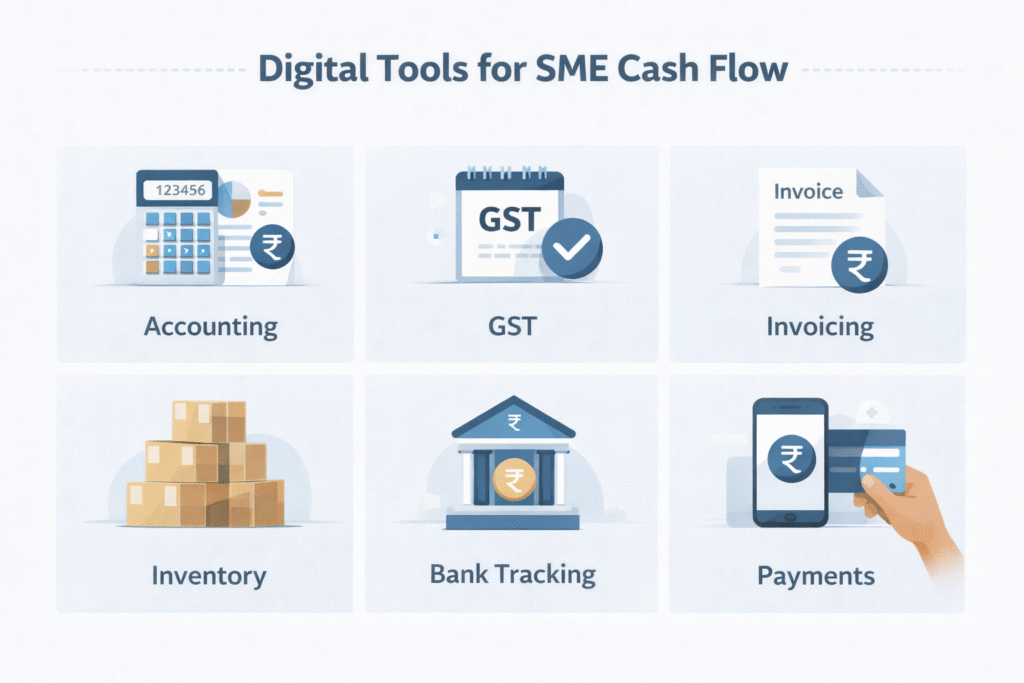

Today, simple digital tools can help business owners:

Understand cash flow clearly

Track receivables and payables

Make smarter decisions

Prepare better for funding or expansion

Here are 7 essential digital tools every SME should consider using to track cash flow and support long-term growth.

1. Accounting Software (The Foundation Tool)

This is non-negotiable.

Whether a business is small or growing, accounting software provides the single source of truth for finances.

What it helps with

Profit & loss visibility

Expense tracking

Balance sheet clarity

GST-ready reports

Bank reconciliation

Popular options for Indian SMEs

Tally

Zoho Books

QuickBooks

Businesses using proper accounting software:

Get faster loan approvals

Avoid compliance surprises

Understand real profitability

Without this, every other tool becomes less effective.

2. GST Filing & Compliance Tools

GST compliance directly impacts cash flow. Delays or mismatches can block input credits and raise red flags for lenders.

What GST tools help with

Timely return filing

Invoice matching

ITC tracking

Compliance accuracy

Commonly used tools

Clear

Zoho GST

GST modules inside accounting software

SMEs that stay GST-compliant enjoy:

Better liquidity

Stronger credibility

Faster financial evaluations

3. Bank Statement & Cash Flow Tracking Tools

Knowing how much money is in the bank is not enough. Businesses must know when money comes in and when it goes out.

What these tools help with

Daily inflow and outflow tracking

Identifying cash gaps

Understanding EMI affordability

Monitoring payment cycles

Many accounting platforms now offer:

Auto bank feeds

Cash flow dashboards

Alerts for low balances

Clear visibility reduces surprises and panic borrowing.

4. Invoicing & Receivables Management Tools

Delayed payments are one of the biggest reasons SMEs face cash stress.

Digital invoicing tools help businesses:

Issue invoices quickly

Track due dates

Send reminders automatically

Reduce follow-ups

Why this matters

Even profitable businesses fail when receivables are not controlled.

Popular invoicing solutions:

Zoho Invoice

Vyapar

Integrated accounting software

Businesses that track receivables well:

Improve cash cycles

Reduce dependency on emergency funding

Strengthen client discipline

5. Inventory Management Tools

Inventory locks up cash. Excess stock means blocked money. Low stock means missed sales.

Inventory tools help balance both.

What they help with

Stock level visibility

Fast-moving vs slow-moving items

Purchase planning

Cost control

Industries that benefit most:

Traders

Retailers

FMCG distributors

Textile and garment businesses

Integrated inventory tracking improves cash flow without increasing borrowing.

6. Payment Collection & Digital Payment Tools

Faster collections improve liquidity immediately.

Digital payment tools help businesses:

Collect money instantly

Reduce cash dependency

Track payment history

Improve transparency

Common tools

UPI & QR-based systems

Payment gateways

Business banking apps

When collections become faster, pressure on working capital reduces automatically.

7. Simple Budgeting & Forecasting Tools

Growth without planning creates stress.

Even basic forecasting tools help SMEs:

Plan expenses

Prepare for seasonal demand

Anticipate cash shortages

Decide when funding may be required

This doesn’t require complex software.

Even spreadsheet-based planning works if done consistently.

Businesses that forecast:

Borrow less urgently

Negotiate better

Grow with confidence

Why Digital Tools Matter Beyond Operations

Digital discipline is no longer just about internal efficiency.

It directly impacts:

Loan approval speed

Credit eligibility

Interest rates

Investor confidence

Expansion readiness

Lenders and finance partners increasingly rely on:

Clean data

Transparent records

Predictable cash flow

Businesses using digital tools are simply easier to support.

Where Sunrays Finance Fits In

At Sunrays Finance, funding decisions are based on how a business operates in reality, not just paperwork.

SMEs that use digital tools:

Get evaluated faster

Face fewer questions

Receive better-structured funding

Sunrays supports businesses that maintain clarity — and helps others move toward it.

Final Thought

Cash flow issues rarely appear overnight. They build slowly through poor visibility, delayed tracking, and lack of planning.

Digital tools give SMEs control — not complexity.

Businesses that track money well:

Borrow smarter

Grow faster

Sleep better

Technology doesn’t replace business instinct — it strengthens it.