The Decision Every Business Owner Eventually Faces…

Every growing business hits that moment:

“Do I take a short-term loan and move fast, or pick a long-term loan and play it safe?”

It’s not a small decision.

It can shape your cash flow, expansion speed, and even your peace of mind.

The challenge?

Most SMEs don’t fully understand the difference — and end up choosing loans based on urgency rather than strategy.

At Sunrays Finance, we’ve worked with thousands of small businesses, and one thing is clear:

The right loan isn’t the cheapest loan — it’s the loan that aligns with your business cycle.

Let’s break it down simply, without the jargon and banker-speak.

1. What Is a Short-Term Business Loan?

A short-term loan typically runs from 3 months to 18 months, and is designed for quick financial needs.

When do businesses actually need it?

When payments from clients get delayed

When you want to purchase inventory for a seasonal spike

When a big order suddenly comes in

When you need working capital TODAY, not after 20 days of approvals

When you’re waiting for invoices to clear

Short-term loans move quickly because the lender understands that opportunity doesn’t wait.

Key Features

Tenure: 3 to 18 months

Processing time: Very fast

Collateral: Usually not required

EMI size: Higher (due to shorter duration)

Used for: Cash flow gaps, inventory, machinery repair, quick expansion

If your business relies heavily on speed — FMCG, distribution, textiles, logistics, trading — this type of loan can literally save your month.

2. What Is a Long-Term Business Loan?

A long-term loan usually stretches from 2 years to 7 years.

Think of it as a “big vision” loan — for businesses that want to scale, upgrade, build, or expand.

When businesses need long-term loans

Opening a new branch

Buying large machinery

Expanding warehouse or factory capacity

Purchasing commercial vehicles

Building long-term infrastructure

Long-term loans come with lower EMIs because the repayment is spread over years — but the catch is slower approval and more paperwork.

Key Features

Tenure: 2 to 7 years

Processing: Slower (banks/NBFCs)

Collateral: Usually required

EMI size: Lower

Used for: Heavy expansion, machinery, vehicles, real estate

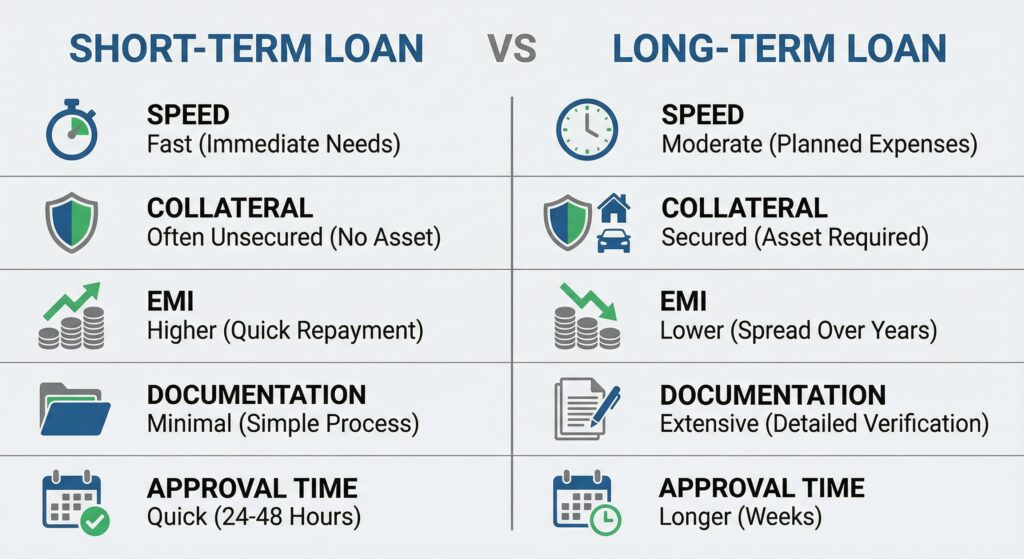

3. Short-Term vs Long-Term Loans — A Simple Comparison

Short-Term Loan

Speed: 🔥 Fast

Collateral: ❌ No

Purpose: Cash flow, seasonal demand

EMI: High

Approval: Quick

Flexibility: High

Long-Term Loan

Speed: 🐢 Slow

Collateral: ✔ Yes

Purpose: Expansion, assets

EMI: Low

Approval: Detailed

Flexibility: Medium

But here’s the truth:

Most SMEs don’t actually need one or the other — they need the right one based on their business timing.

Which brings us to…

4. How to Choose the Right Loan for YOUR Business

A. Check Your Cash Flow Stability

If your income is fluctuating, opt for a short-term loan.

If your income is steady, you can comfortably manage a long-term EMI.

B. Understand Your Business Cycles

Every business has a rhythm:

Garments: Seasonal peaks

FMCG: Consistent but cycle-based

Construction: Payment-driven

Logistics: Contract-based

Match your loan tenure with your money cycle — not with what the bank offers.

C. How urgent is the money?

If you need funds within 48–72 hours, long-term loans will delay your opportunity.

Short-term private financing wins here.

D. Do you want flexibility?

Short-term loans usually offer:

Minimal paperwork

No collateral

Faster repayment cycles

No property evaluation

Simple renewal

For SMEs, that flexibility is priceless.

5. Real Scenarios From the Ground (Anonymous Case Studies)

Case Study 1: The Textile Retailer (Chennai)

Ramesh gets bulk wedding orders in November–December.

He needs fast inventory.

Banks say:

“Submit audited balance sheets.”

“Provide property documents.”

“Wait 12 working days.”

He loses the order.

With a short-term cheque-based loan, he gets funds in 36 hours, buys stock, and makes a 40% profit.

Lesson: Seasonal businesses = SHORT TERM.

Case Study 2: The Auto Components Manufacturer (Coimbatore)

Needs a new CNC machine worth ₹35 lakh.

Short-term loan EMI would kill his cash flow.

Long-term EMI spreads it out → business grows steadily.

Lesson: Long-term assets = LONG TERM.

Case Study 3: The Distributor (Trichy)

Client payments come every 45 days but distributors need to pay suppliers every 7 days.

Cash flow mismatch ruins credit scores and supplier relationships.

A rolling short-term finance cycle fixes everything.

Lesson: Payment delays = SHORT TERM.

6. Mistakes Businesses Make While Choosing Loan Types

❌ Mistake 1: Choosing based on interest rate alone

A lower rate doesn’t help if approval takes 20 days and you lose the opportunity.

❌ Mistake 2: Not matching EMI cycle with business cycle

Your loan should breathe with your business.

❌ Mistake 3: Taking a long-term loan for short-term needs

You end up paying unnecessarily for years.

❌ Mistake 4: Using collateral for unsafe short-term needs

Never put your house or land at risk for inventory.

7. What Sunrays Finance Recommends

We’ve studied thousands of SME cases, and the formula is simple:

Choose a short-term loan when you need:

Speed

Flexibility

Zero collateral

Quick opportunity

Inventory support

Cash flow gap coverage

Choose a long-term loan when you need:

Stability

Asset creation

Lower EMI

Capacity expansion

Infrastructure building

Always choose the loan that supports your growth — not your stress.

8. Final Thought

Short-term and long-term loans aren’t competitors.

They’re tools.

Used correctly, they can:

Strengthen your business

Expand your opportunities

Build your future

Used wrongly, they can drain your cash flow and increase pressure.

At Sunrays Finance, our job is simple:

Help SMEs choose the right financial path — fast, fair, and without complications.

If you ever need short-term, collateral-free finance to grab an opportunity, expand quickly, or cover a cash crunch — we’re here.

📞 Call 7200005385

🌐 sunraysfinance.com